Decree 29-89

Law for the Promotion and Development of Export and Maquila Activities

The purpose of the Law for the Promotion and Development of the Export and Maquila Activity is to promote, encourage and develop in the national customs territory, the activities of individuals or legal entities domiciled in the country, operating within the customs regimes established therein.

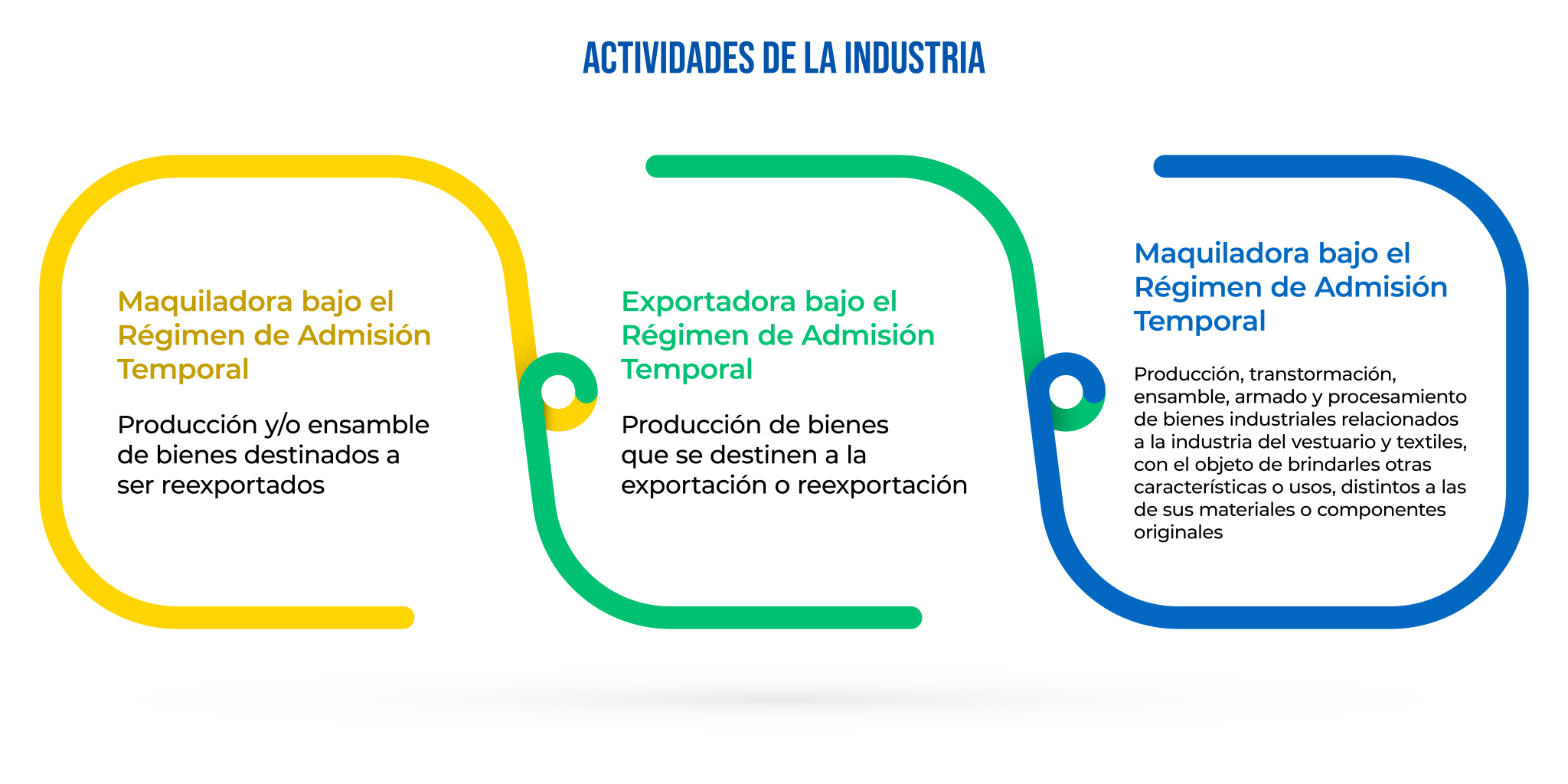

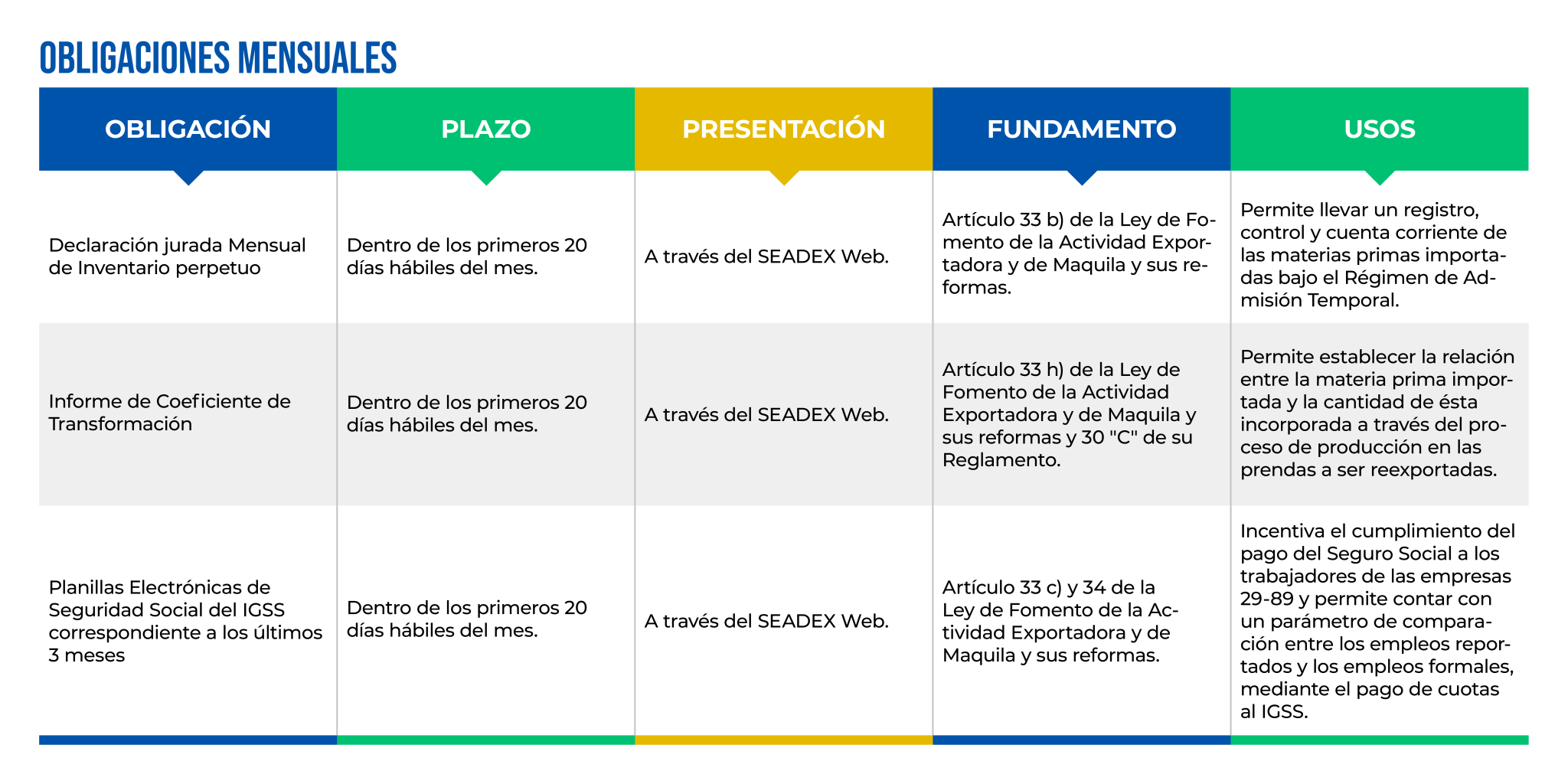

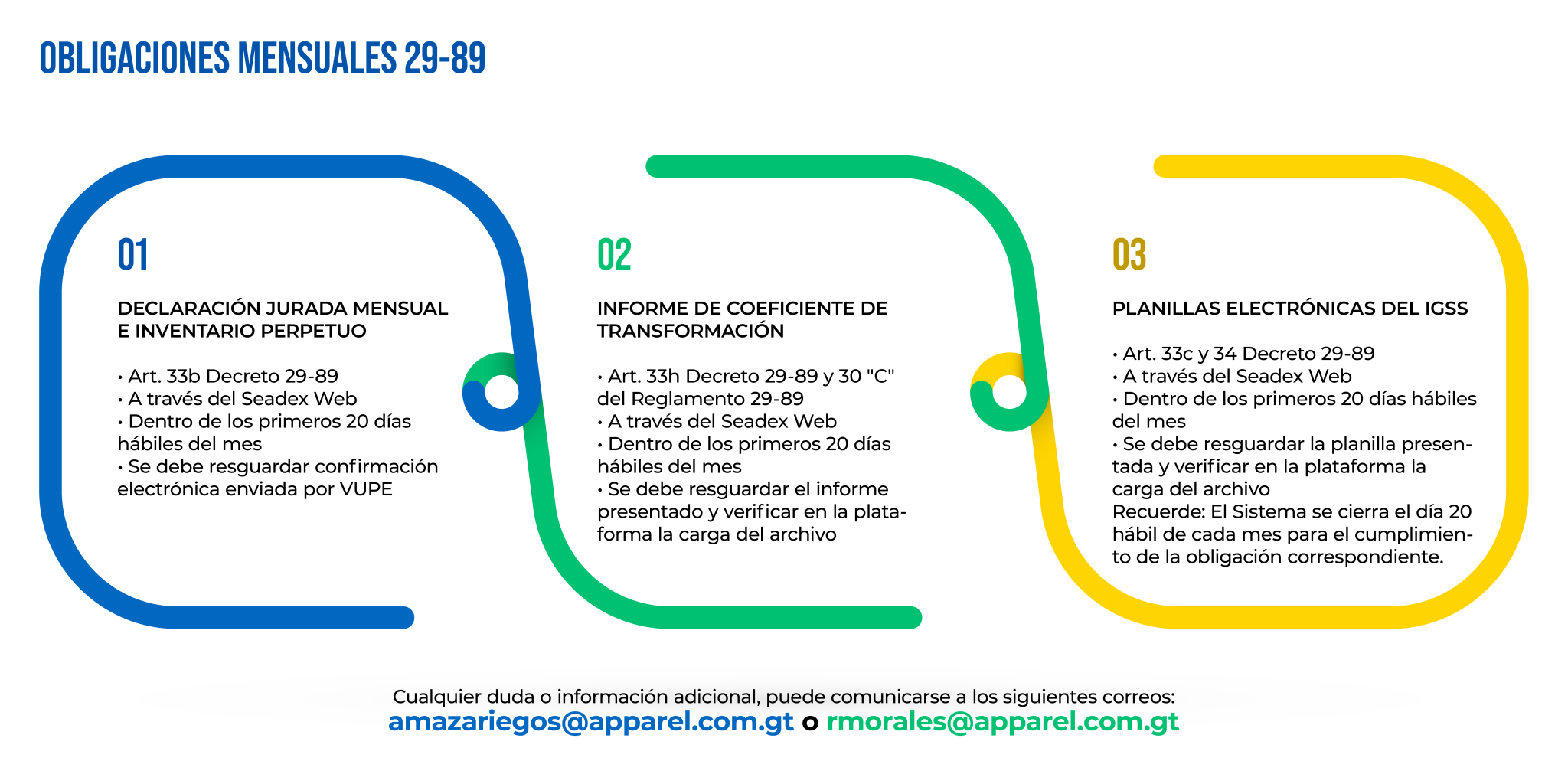

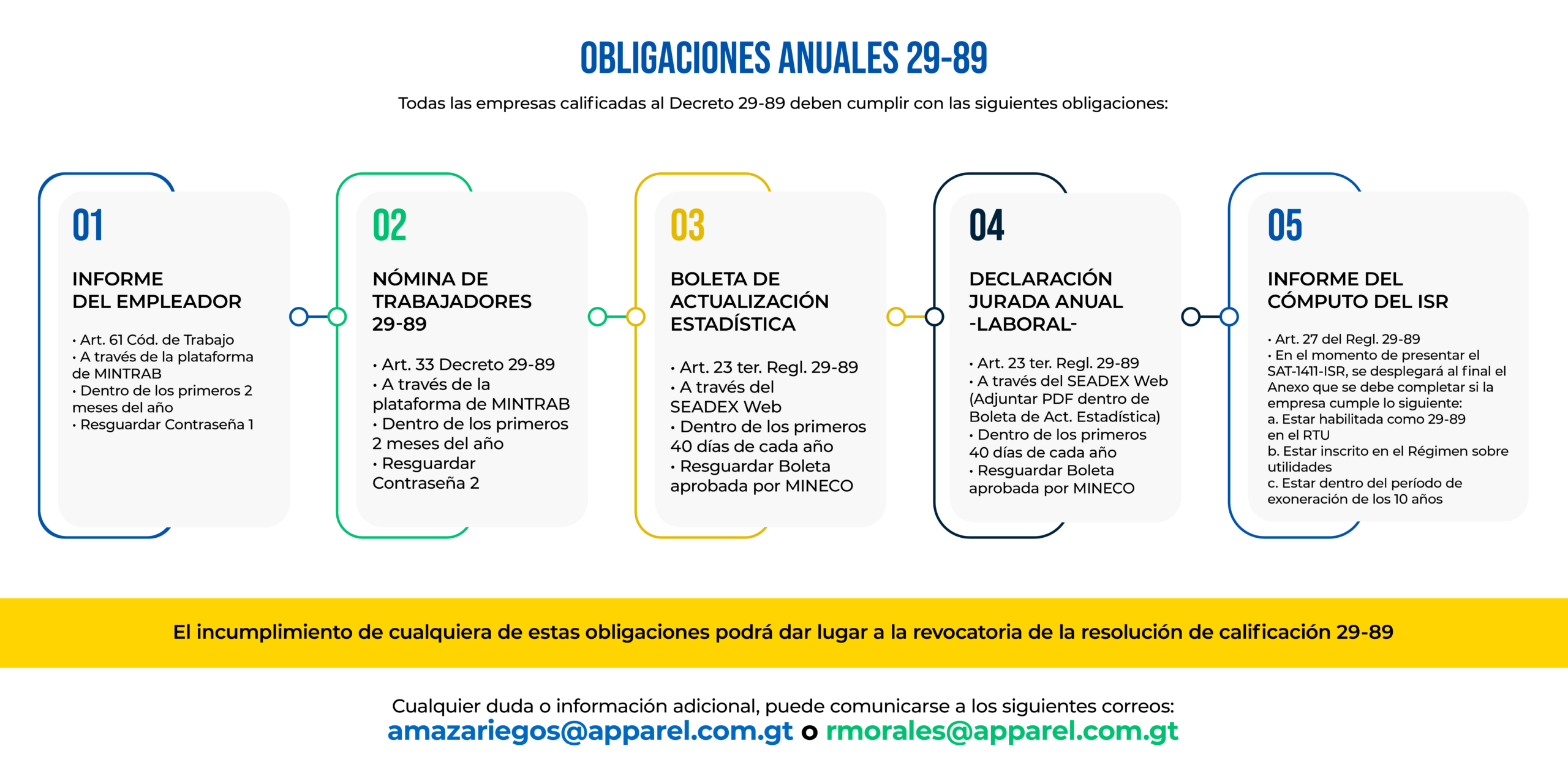

Law for the Promotion and Development of the Export and Maquila Activity, Decree Number 29-89 of the Congress of the Republic of Guatemala. This legislation recognizes maquilas under the Temporary Admission Regime, which allows the entry of goods into the national customs territory with suspension of tariffs, import taxes and Value Added Tax (VAT). These goods are destined to be exported or re-exported within one year after having undergone transformation or assembly.

In addition, VAT is exempted for the acquisition of locally produced inputs incorporated in the final product, as well as services used exclusively in its economic activity. This regime also contemplates the exoneration of Income Tax for the authorized activity for a period of 10 years. Within this Temporary Admission Regime are included both the maquila activity and the production and exportation.